All Categories

Featured

Table of Contents

- – Eyeglass Insurance For Seniors Rancho Santa Mar...

- – Harmony SoCal Insurance Services

- – Medicare Supplement Insurance Near Me Rancho S...

- – Senior Insurance Plans Rancho Santa Margarita, CA

- – Medical Insurance For Senior Rancho Santa Mar...

- – Best Senior Medical Insurance Rancho Santa M...

- – Harmony SoCal Insurance Services

Eyeglass Insurance For Seniors Rancho Santa Margarita, CA

Harmony SoCal Insurance Services

2135 N Pami Circle Orange, CA 92867(714) 922-0043

https://maps.google.com/maps?ll=33.823884,-117.830838&z=16&t=h&hl=en&gl=US&mapclient=embed&cid=276141583131225364

It is necessary to assess your choices right now to make certain you remain to have the Medicare health and wellness and drug coverage you want. Some sorts of Medicare health insurance aren't Medicare Advantage Program, but are still part of Medicare. The coverage they provide varies relying on the details sort of strategy.

Medicaid likewise covers extra solutions past those supplied under Medicare, consisting of nursing facility care beyond the 100-day limitation or experienced nursing facility treatment that Medicare covers, prescription medications, glasses, and hearing help. Services covered by both programs are first paid by Medicare with Medicaid loading in the distinction approximately the state's payment limit.

* Features available vary by plan. *Please keep in mind, MVP is called for by legislation to send out some strategy papers by postal mail. +MVP digital treatment solutions via Gia are available at no cost-share for the majority of participants. In-person brows through and references are subject to cost-share per plan. Exceptions exist for self-funded plans. Gia telemedicine solutions will be $0 after the deductible is fulfilled on MVP QHDHPs beginning January 1, 2025, upon plan renewal unless the Affordable Care Act 2023 QHDHP/HSA safe harbor is further expanded.

Health advantage strategies are issued by MVP Health Plan, Inc., an operating subsidiary of MVP Health Treatment, Inc. Not all strategies offered in all states and areas. Each year, Medicare evaluates strategies based upon a 5-star score system. Out-of-network/non-contracted providers are under no commitment to treat MVP Health Strategy participants, except in emergency situation circumstances.

Medicare Supplement Insurance Near Me Rancho Santa Margarita, CA

Pay attention to this web page. Best Insurance Companies For Seniors Rancho Santa Margarita. Your internet browser does not sustain the audio component. If you are a PSERS senior citizen, survivor annuitant, or the partner or dependent youngster of a PSERS senior citizen or survivor annuitant, and you are qualified for Medicare, you can sign up in: Medicare Supplement plan: HOP Medical Plan Worth Medical Plan Medicare Advantage strategy (Highmark, Aetna, Independent Blue Cross, Capital Blue Cross, or UPMC) If you keep Initial Medicare, you can supplement it by signing up in a Medicare Supplement strategy

Protection while traveling abroad is restricted to solutions covered by Medicare. Pay a yearly insurance deductible ($257 in 2025) before the Plan starts cooperating the expense of protected services. Note: If you exhaust your Medicare advantages, this strategy does not supply extra protection. Pay a $300-per-admission copay if you are admitted to the health center.

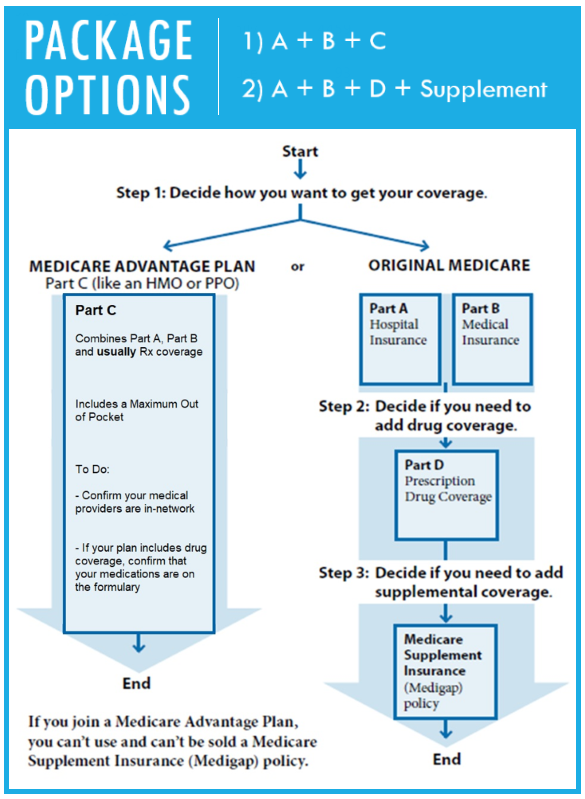

You can select a Medicare Benefit strategy as opposed to Initial Medicare and a Medicare Supplement strategy. Emphasizes: Plan integrates clinical and prescription medicine advantages in a solitary program. If you pick this choice, you can not enlist in any type of various other Medicare prescription drug strategy. Insurance policy firms have gotten with the federal government to provide Medicare benefits.

Each plan offers only certain areas, so the strategies available to you depend upon where you live. You should utilize an in-network carrier to receive the optimum benefit. See the local Medicare Benefit plan guides for descriptions of the Medicare Advantage prepares readily available where you live, the benefits they offer, and their prices.

Senior Insurance Plans Rancho Santa Margarita, CA

There is no one-size-fits-all decision when it comes to selecting the finest Medicare strategy, as people have different conditions, demands, and top priorities. Various other considerations play a function, the decision might come.

down to weighing the considering benefits adaptability Original Medicare initial the versus benefits of Medicare Advantage plansBenefit For lots of senior citizens, a great option is Initial Medicare (Parts A and B)with Medicare Supplement Plan G from AARP/UnitedHealthcare (UHC)if you do not mind paying even more per month for more versatility when it comes to selecting your medical professional.

Medical Insurance For Senior Rancho Santa Margarita, CA

Medicare Supplement(Medigap)intends cover numerous of the prices that you typically pay if you have regular Medicare. You'll usually pay much less when you obtain clinical treatment with a Medigap plan than with a Medicare Advantage strategy. If you pick Original Medicare, the only means to have insurance coverage for prescription medicines is to authorize up for a stand-alone prescription drug plan called Medicare Component D. Even the economical strategies usually supply an excellent worth for the coverage you get.

If you are not working after 65, then a Professional at can contrast all of your Medicare alternatives for you right over the phone. Locals in Pennsylvania have the alternative to enlist into a Medicare Supplement Strategy( Medigap), Prescription Medicine Strategy (Part D or PDP )or a Medicare Advantage Plan( Part C). These plans are state-wide; significance anyone in Pennsylvania can register into one . While your costs is figured out by your state, you have the ability to utilize your benefits nationwide. Medicare Supplements are non-network-based strategies, suggesting you can see any type of physician or professional that approves Medicare. Medicare Supplement Plans are designed to assist cover coinsurance, deductibles and copays. Prescription Drug Plans are stand-alone policies supplied by personal insurance coverage carriers. As pointed out, they can be bought to accompany your Medicare Supplement Strategy or acquired alone to enhance your Initial Medicare Components A and B. Prescription Medicine Program are not meant to cover 100 %of your prescription cost, yet to assist reduce your costs. If you require Extra Assist paying for your prescriptions, please visit this site. Medicare Benefit Plans are supplied by personal insurer. These strategies are regulated and approved by CMS, the Centers of Medicaid and Medicare Solutions.

Best Senior Medical Insurance Rancho Santa Margarita, CA

Medicare Supplement Plans are health and wellness insurance policies that supply standardized benefits to function with Initial Medicare( not with Medicare Advantage). These strategies may cover outstanding deductibles, coinsurance, and copayments and may also cover wellness treatment expenses that Medicare does not cover at all, like treatment got when taking a trip abroad. When you come to be eligible for Medicare, you may need to register in both Medicare Part A(Hospital Insurance Coverage)and Part B(Medical Insurance)to get complete benefits from your retiree coverage.

If you select not to sign up with a Medicare medication plan, you'll require to have reputable drug coverage to stay clear of paying a Component D late registration fine. Creditable drug protection is coverage that gives the very same worth as Medicare medication coverage. If you're not exactly sure your senior citizen medication strategy is considered creditable, ask your plan they need to tell you. Get in touch with your advantages manager before making any decisions.Who receives Additional Assist? Because Medicare pays initially after you retire, your retired person protection is probably similar to insurance coverage from a Medicare Supplement Insurance Coverage(Medigap)policy. Both are likely to provide benefits that fill out several of the voids in Medicare coveragelike coinsurance and deductibles. Medicare is the Federal health insurance policy program for individuals 65 years old or older. You might additionally be eligible for Medicare before age 65 if you have an impairment, End-Stage Kidney Condition(ESRD), or ALS(Lou Gehrig's disease). (healthcare facility insurance policy )covers in-patient treatment obtained at a hospital, competent nursing facility, or hospice and some home healthcare. cover what Medicare Parts A and B cover and some added advantages like certain dental, vision, and hearing benefits. Medicare Advantage intends accessed through FEHB provide drug coverage similar to Part D drug protection. * Additional registration alternatives are detailed

below. There are various means to enroll in Medicare when you have FEHB. Your if it offers Medicare medication benefits and you're eligible for Part D. You are qualified for this benefit if you just have Medicare Component A or Part B or both Part A and Part B. You have the alternative to opt-out by calling your FEHB strategy before coverage starts. Disenrollment elections work the very first day of the complying with month. You need to have Part A and Component B to choose a Medicare Advantage strategy accessed through FEHB. Use the strategy contrast tool to discover a plan. Contact the strategy straight or follow the guidelines in the strategy brochure to sign up. If you do not get Social Protection or RRB advantages, enroll in Part A and Part B online at gov, by phone at 1-800-772-1213, or in-person at your local SSA workplace.

Harmony SoCal Insurance Services

Address: 2135 N Pami Circle Orange, CA 92867Phone: (714) 922-0043

Email: [email protected]

Harmony SoCal Insurance Services

You have to have Part A and/or Component B to choose a Part D strategy. Use the Medicare Strategy Finder to find a Part D medicine plan and enlist. Or call Medicare at 1-800-633-4227, TTY individuals can call 1-877-486-2048. You need to have Part A and Component B to choose a Medicare Benefit strategy. Many Medicare Benefit intends offer medicine coverage. Because situation, you'll get drug protection as part of your enrollment. Discover strategies and enroll by utilizing the Medicare Plan Finder.

Rancho Santa Margarita, CARancho Santa Margarita, CA

Rancho Santa Margarita, CA

Find A Good Seo Services Near Me Rancho Santa Margarita, CA

Near Here Seo Services For Business Rancho Santa Margarita, CA

Best Insurance Companies For Seniors Rancho Santa Margarita, CA

Harmony SoCal Insurance Services

Table of Contents

- – Eyeglass Insurance For Seniors Rancho Santa Mar...

- – Harmony SoCal Insurance Services

- – Medicare Supplement Insurance Near Me Rancho S...

- – Senior Insurance Plans Rancho Santa Margarita, CA

- – Medical Insurance For Senior Rancho Santa Mar...

- – Best Senior Medical Insurance Rancho Santa M...

- – Harmony SoCal Insurance Services

Latest Posts

Rancho Penasquitos Water Heater Installation

Bernardo Village Plumber Repairs Near Me

Gas Plumber Scripps Ranch San Diego

More

Latest Posts

Rancho Penasquitos Water Heater Installation

Bernardo Village Plumber Repairs Near Me

Gas Plumber Scripps Ranch San Diego